What is GST - Explained [Basics of why GST, What is GST]

Indian had adopted GST on 1st July 2017. Perceptions of different types being distributed by different professions. Let us know a bit basic that is needed for a common man (or for a layman as far as taxation is concerned).

Global practice.

Almost 80% of total countries in the world run their taxation with GST system. It is not at all political to judge if GST is good or bad. It is a taxation system which has drawn most of the countries which surely has its advantage.

Just to mention, two big economies like United States of America and China do not have GST implemented. While China has a very complicated taxation system and just completed VAT reform in their country in the year 2016 and US prefers to keep autonomy to states.

Most of the developed nations in the world has adopted to GST system of tax. France was first country to implement GST way back in 1954.

Indian Context of GST

India has duel GST in place (state / union territory GST and central GST). India’s GST system is similar to geographically bigger countries like Brazil and Canada. Multiple rate of GST is also another feature in India and such countries.

\

Advantage of this tax system

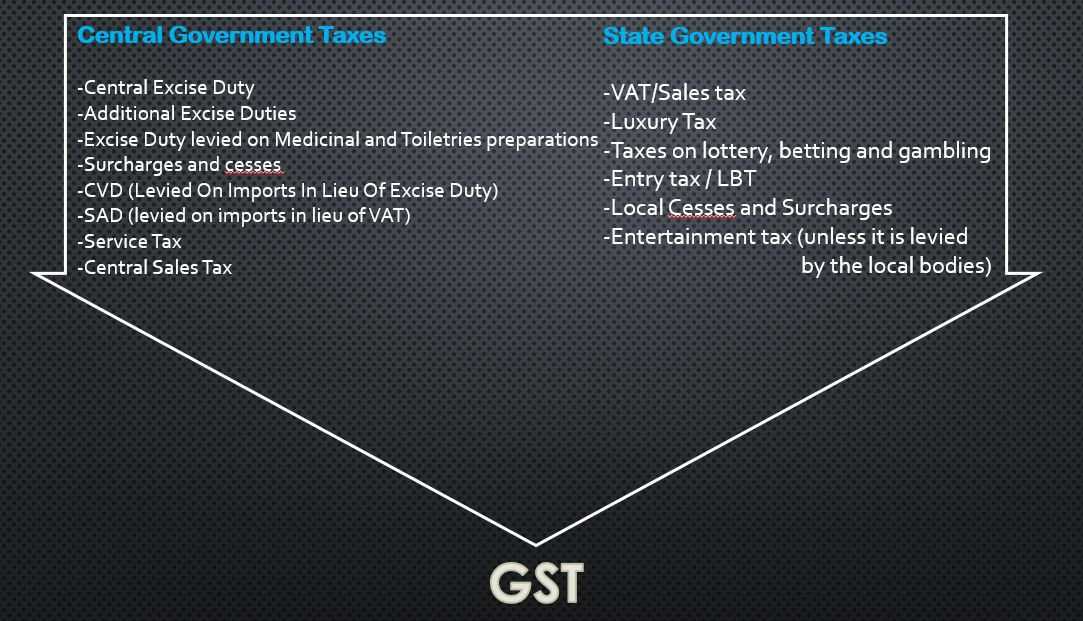

- Elimination of multiple tax is the first and major benefit of GST over any other tax regime. Remember the slogan, one Nation one Tax? With implementation of GST India has abolished many taxes namely entry tax, entertainment tax, luxury tax, octroi, LBT, service tax, excise duty, (except in only few notified commodities like petrol, diesel) etc.

- Set-off against earlier paid tax is another major advantage in the GST system tax. More importantly unlike previous tax systems, taxes paid against other goods / services (now that all falls under GST) can be taken for set off in to while filing returns.

- This taxation system has broadened tax base.

While the act permits exemption to file return of GST up to turnover of 20L, on the other aside, the system has forced many traders to register and pay due tax. Many were managing not to pay tax probably by manipulating books or by not showing transactions to tax authorities. As mentioned above, the GST allows the buyer to take setoff of earlier paid tax and hence reducing overall cost impact of their goods and services. The set off can be availed only if the bills (taxable) of their purchase is uploaded in GST portal. Hence every buyer insists their seller (supplier) to file proper return (GSTR-where tax details of the invoice/bill is required to be uploaded).

- GST has benefited many specific business e.g. trucking industry.

Plight of trucker and truck driver is well known fact – which has been discussed my next blog article (GST-made-transporting-more-efficient). The trucks carrying various goods used lined up in each state border for clearing papers to go in and out from one state to another (Sales tax and RTO). Every state would have had in and out to keep track that a transit truck has not unloaded the goods into their state. Now all that are being taken care by e-waybill (another forthcoming topic).

India still needs to solve few concerns for using the world’s most used taxation system in optimized manner

- Limitation of basic infrastructure

Almost every activity in GST has to be performed online. India’s present status computer literacy and infrastructure related to PC/laptop/internet connectivity need not be guessed. It is poor. Now at least govt. has overcome of such issues, in initial days, GSTReturn date was needed to be extended because of bug in the infrastructure/connectivity.

- Till now GST doesnot cover diesel and petrol, which is major concern in the mind of common man.

- Many states have sited lack of autonomy and improper compensation in this taxation system . Anyway, either satisfaction of the state specific or compensation is bound to improve / get corrected only with time.

- GST has imposed high cost on companies for staff training and hiring experts to fully comply to this system.

Undoubtedly, this modern taxation system which is adopted in most of the countries of the world required due time to get settled.

Yes, GST Version 2.0 is awaited

One of the best available reference book.

Taxmann’s GST Ready Reckoner (Budget 2019 Edition)

<!-- Rakuten Automate starts here -->

<script type="text/javascript">

var _rakuten_automate = { accountKey: "d92d4fe0879b784fdd46a4c0568ebf0a811845f53c493cd928932c1643b42f30", u1: "", snippetURL: "https://automate-frontend.linksynergy.com/minified_logic.js", automateURL: "https://automate.linksynergy.com", widgetKey: "Bjarm0xCJgw59e6mbFCz1wJ1RpRsGMkS", aelJS: null, useDefaultAEL: false, loaded: false, events: [] };var ael=window.addEventListener;window.addEventListener=function(a,b,c,d){"click"!==a&&_rakuten_automate.useDefaultAEL?ael(a,b,c):_rakuten_automate.events.push({type:a,handler:b,capture:c,rakuten:d})};_rakuten_automate.links={};var httpRequest=new XMLHttpRequest;httpRequest.open("GET",_rakuten_automate.snippetURL,!0);httpRequest.timeout=5E3;httpRequest.ontimeout=function(){if(!_rakuten_automate.loaded){for(i=0;i<_rakuten_automate.events.length;i++){var a=_rakuten_automate.events[i];ael(a.type,a.handler,a.capture)}_rakuten_automate.useDefaultAEL=!0}};httpRequest.onreadystatechange=function(){httpRequest.readyState===XMLHttpRequest.DONE&&200===httpRequest.status&&(eval(httpRequest.responseText),_rakuten_automate.run(ael))};httpRequest.send(null);

</script>

<!-- Rakuten Automate ends here -->