Two Years of GST

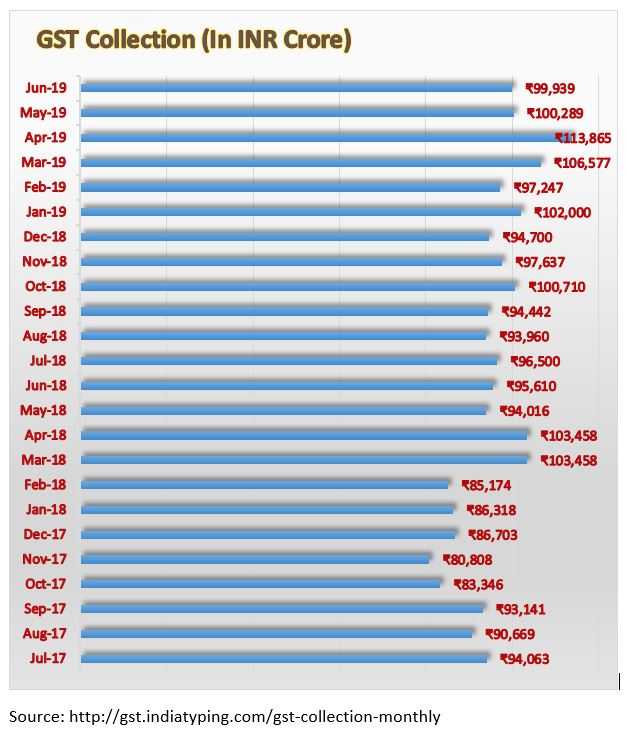

India has implemented GST on 1st July 2017. GST in India has come a long way, it has completed two years of its implementation. It has been a taxation system with increasing acceptance, growing revenue for the government and lesser issues between states and central tax system. Here we look into some of the broader points of the journey so far....

Simplified and friendly slab of tax

GST is presently applicable on every product except Petro products, Tobacco, Alcohol and stamp duty on real estate (Also, there are some other taxes continuing from older regime which are discussed in the later part of this blog) GST has four slabs of 5, 12, 18 and 28 percent. There is also a 0% slab where most of the daily use articles are applicable the latest revision of the tax rates.

The tag ‘One Nation One Tax’ being proved appropriate.

As per government the biggest gain from GST is, it has helped India to integrate into a single common market by breaking the inter-state trade and commerce barriers.

Implementation of GST can also claim the credit of one of major reason for India to jump-up in the world ranking of “ease of doing business”.

In the past two years, government has done a lot to balance the state and central revenue.

As stated in my previous blog, (I wish I knew basics of why gst, what is gst/), the GST merged many other taxes which was maintained before July 2017. It has streamlined seventeen different laws and created one single tax system. The pre-GST rate (or VAT / CST) of taxation was a standard rate for VAT was 14.5%, excise at 12.5% and added with the CST and with the cascading effect (of tax on tax), the tax payable by the consumer was almost 31% odd. The entertainment tax was in force and being collected by the States from 35% to 110%. The tax payers had to file multiple returns, had to work with multiple commercial tax officers and additionally face the inefficiency.

\

Continuous improvement in GST Act

The GST council has been working hard to make the system one of best in the world. Till June 2019, the council has met 35 times and made 90 amendments. The amendments include rolling out newer and easier return system for traders enabling them to file returns in a single format once a month instead of existing multiple formats (this is due to be launched from 01-Oct-2019. Most amendments were on lowering of GST rates for essential commodities. The then finance minister Mr Jaitley had mentioned in his blog that “only luxury and sin goods are now taxed at highest 28 per cent GST rate. Reduction in tax incidence has been the biggest accomplishment of the GST for the people”.

Smoother Transportation

As discussed in my other blog (GST-made-transporting-more-efficient/) it was well known that trucks were being stranded at the State boundaries for days altogether and there were massive payout (both official and unofficial). Now that e-way bill is in place, the flow of interstate traffic is much faster and smoother.

Implementation of GST overhauled this scenario completely. In today’s scenario, there is only one tax, online returns, no entry tax, barriers of inter-state border has been abolished hence truck queues have abolished and movement has become faster.

Government has also brought various changes in the GST system with regard to both quantum of taxes and inclusion and exclusion of items/services.

Significant increase in number of tax complaint business

In the past two years, the number of tax filling assesse base on GST has increased by almost 85 per cent. Number of assesse was approximately 65 lakh on July 2017, which has now almost reached 1.20 crore. Which is a achievement in itself. Format finance minister Mr Arun Jaitley has claimed that this has become possible as the GST act is consumer and assesse friendly.

Some Simplification on GST made it more acceptable

A businesses up to annual turnover of INR40 lakh has been made GST exempt. The business with turnover upto INR1.5 crore has been given to use of the composition scheme and pay only 1% tax. Also, now it has a single registration system which is online. The system is also reviewed and simplified regularly.

A leading newsmaker (LiveMint) reports, The Goods and Services Tax, has expanded the coverage of indirect taxation by about 50% over the tax base earlier which added in a handsome number of 3.4 million new tax payers, and more importantly, GST has made taxation more transparent and difficult to evade. [The report link https://www.livemint.com/news/india/as-gst-turns-two-businesses-seek-further-simplification-subsidy-support-1561923558701.html ] it also highlights that the GST has left some important tax collection sources out of scope. e.g. fuel, electricity etc.

Few old regime tax yet to be scrapped

Traders are hoping that the taxes like mandi tax, stamp duty, road tax and vehicle tax are still out of preview of GST. These taxes are also not uniform at a state level. If you talk about Mandi tax, the companies who are procuring grain needs to pay 6 percent in Punjab, 4 percent in Haryana and 0.20 percent in the state of MadhyaPradesh. These highly fluctuating rate of same tax in different states is seen as discrepancy in taxation system by every trader be it a local small company or an MNC. The kind of issues are actually burden for every organization. This is the reason, we very often listen news of the industry bodies demanding for bringing all these under one umbrella of GST. The motive behind the demand is to avail smooth credit of tax and hence cost of many business can be reduced.

Rate of tax

Af per statement of former FM, only luxury items and sin goods are taxed at28%. But we find automobile (except electric vehicle) and many components are also taxed at 28%. Where cars may be treated in luxury segment but commercial vehicles (trucks and buses) are backbone of this developing economy. Probably a review on the rate of GST on this industry is pending.

Requirement of technology efficiency for being tax complaint

To comply the tax laws and submit returns the smaller traders needs to become technology equipped, which is not there for more than 50% of these traders. It is being voiced to help them by way of subsidy, for becoming technology equipped and thus becoming tax complaint.

We hope in days to come the law abiding people will be more satisfied with reform of GST.

Basic technicalities of GST

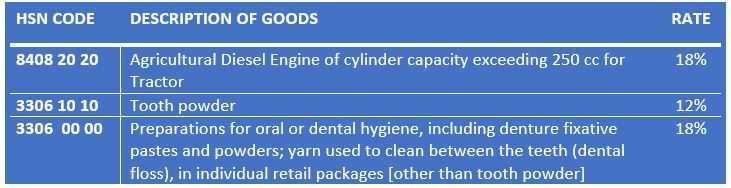

How are GST rates are identified and defined:

- India has adopted HSN for identifying tax rate of goods and

- SAC for identifying tax rate of services

HSN

GST Rates are published against HSN Code (Harmonized System of Nomenclature). Which is a 8 Digit number. It is written as 0000 00 00

The HSN has been devised by World Customs Organization (WCO) to classify goods in a systematic manner throughout the world.

Similar to the International HSN Codes, GST follows a Service Accounting Code (SAC) for the services.

A sample of some HSN Code and its description is given below:

List of HSN Code is available in many government websites e.g. http://www.wbcomtax.nic.in/GST/GSTFAQ/GSTHSN_CODES.pdf gives the list in PDF.

SAC

SAC codes (Full form: Services Accounting Code) are codes issued by CBEC (Central Board of Excise & Customs) to uniformly classify each services under GST

Example of HSN description and applicable GST

We shall come back with some answers of regular basic questions received on GST. We will also present some more basic technical knowledge for common man.

Keep visiting the site. Thank You.

for Some more business specific information please visit : https://digitalregion.in/

One of the best available reference book.

Taxmann’s GST Ready Reckoner (Budget 2019 Edition)

__________________